May 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

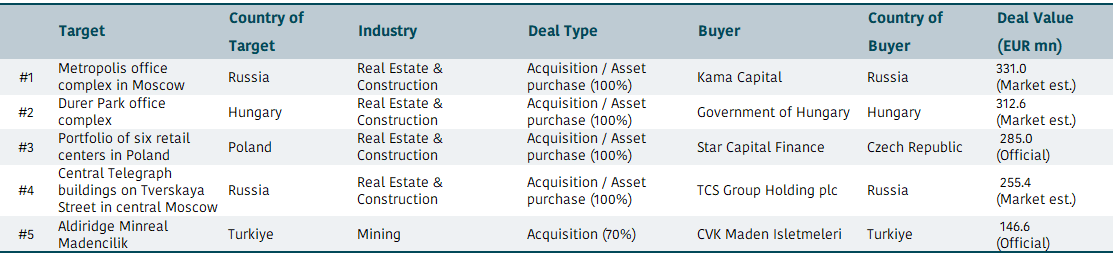

Emerging Europe

Russian investment holding company Kama Capital acquired the Metropolis business center in Moscow from U.S. fund Hines Russia & Poland Fund and Czech real estate company PPF Real Estate. The acquisition marks PPF's last large asset in Russia. While financial terms were not disclosed, sector insiders estimate the office center's market value at some EUR 332mn. The Metropolis complex consists of three Class A office buildings covering 110,000 m² on Leningradsky Prospekt.

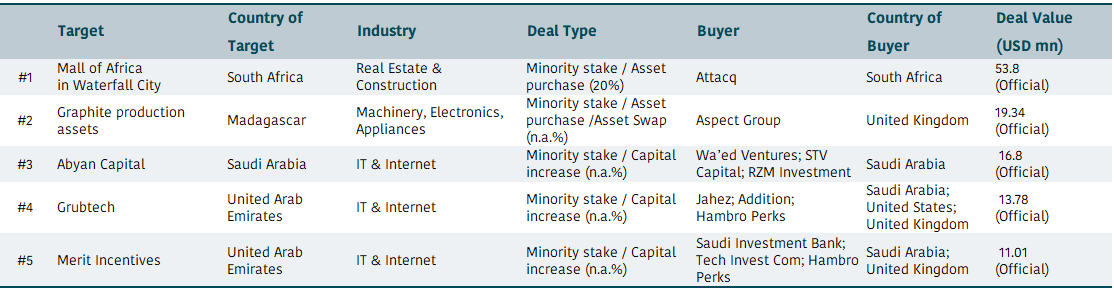

Middle East & Africa

South African real estate investment trust Attacq announced that it will acquire the remaining 20% stake in Mall of Africa in Waterfall City from Atterbury Property Holdings for ZAR 1.1bn (USD 57.9mn). This purchase aligns with Attacq's strategy to invest in precincts it owns and controls. Built in 2016, Mall of Africa is a super-regional mall with a gross lettable area of 129,418 m. Attacq's property portfolio is valued at over ZAR 28bn (USD 1.5bn) and is listed on the Johannesburg Stock Exchange.

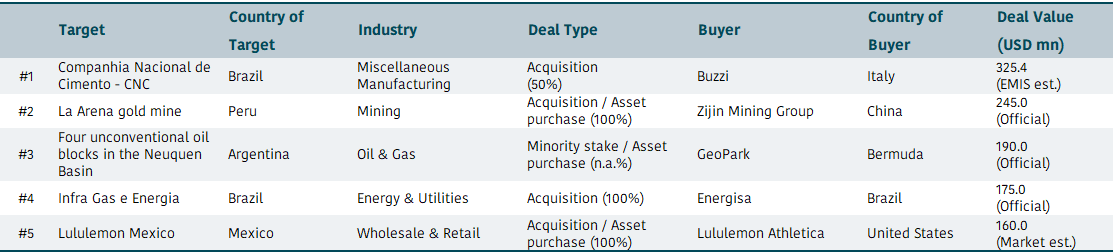

Latin America and the Caribbean

Italian building materials manufacturer Buzzi announced it will acquire the remaining 50% stake in Brazilian cement producer Companhia Nacional de Cimento (CNC) from Brennand Cimentos for an estimated EUR 300mn (USD 325.4mn). CNC produces concrete products under the Cimento Nacional brand and serves customers in Brazil with its five integrated cement plants and two grinding centers with a total capacity of over 7.2 million tons per year.

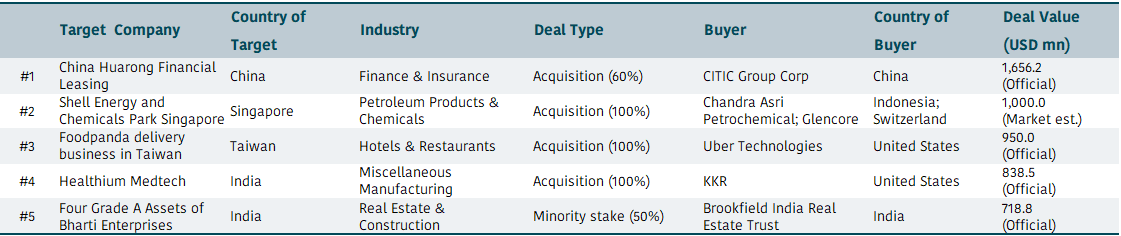

Emerging Asia

China CITIC Financial Asset Management, a Hong Kong-listed financial services provider, announced it will divest a 60% stake in China Huarong Financial Leasing to investment company CITIC Group Corp for CNY 12bn (USD 1.7bn). The deal allows China CITIC to focus on its core business. China Huarong Financial Leasing, founded in 1984, specializes in various leasing services. CITIC Group offers a diversified portfolio including insurance, banking, and asset management.

Are you interested in M&A intelligence? Request a demo of our platform here