October 2024 top M&A deals in emerging markets by region

By EMIS DealWatch

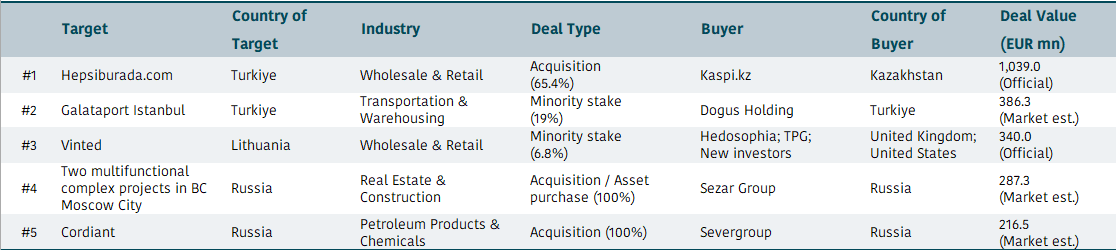

Emerging Europe

Kazakh fintech company Kaspi.kz will acquire a 65.4% stake in Turkish e-commerce platform Hepsiburada from the Dogan family for USD 1.1bn. The transaction, expected to close in Q1 2025, aims to expand Kaspi.kz's reach to a market of 100 million people and boost digital and e-commerce growth in Kazakhstan and Turkiye. Hepsiburada, founded in 2000, is a leading Turkish e-commerce platform with 66 million members, 101,000 merchants, and a 2023 GMV of USD 4bn. Kaspi.kz, known for its Super App ecosystem, connects consumers and merchants through integrated payment, marketplace, and fintech services, serving millions in Kazakhstan.

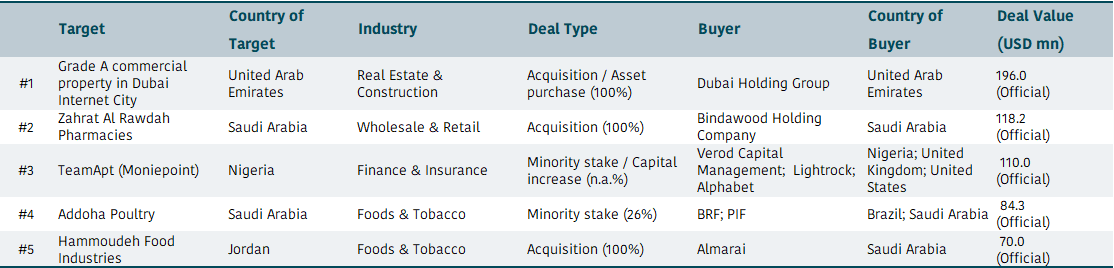

Middle East & Africa

UAE-based real estate firm TECOM Group said it agreed to acquire the Grade A Office Park property in Dubai Internet City from Emirates REIT for AED 720mn (USD 196mn). The property, featuring five interconnected blocks with a gross leasable area of 34,445 m2, aligns with TECOM’s growth strategy and strengthens its leadership in Dubai's commercial real estate market. Established in 1999, TECOM develops business districts in Dubai and is majority-owned by Dubai Holding.

Latin America and the Caribbean

Argentinian hydrocarbon producer Pluspetrol has agreed to acquire six oil blocks in Vaca Muerta, Neuquén province, from U.S.-based ExxonMobil for an estimated USD 1.7bn, according to Econojournal. The acquisition enhances Pluspetrol's portfolio and strengthens its presence in Argentina's prominent hydrocarbon sector. Founded in 1977, Pluspetrol specializes in oil and gas exploration and production, operating across six countries, including Argentina, Angola, Bolivia, Colombia, Ecuador, and Peru.

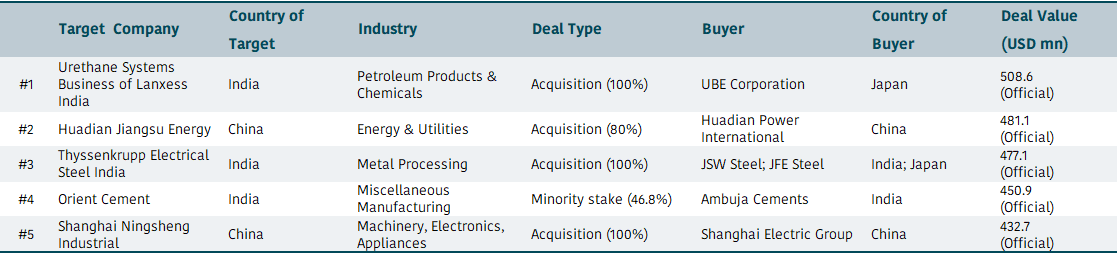

Emerging Asia

Chemicals manufacturer Lanxess India announced the sale of its Urethane Systems Business to Japan's UBE Corporation at an enterprise value of EUR 460mn (USD 508.64mn). The deal, expected to close in the first half of 2025 pending regulatory approvals, will help Lanxess focus on debt reduction. UBE aims to expand its product portfolio and strengthen operations through the acquisition. The Urethane Systems Business includes five global manufacturing sites, application labs in the USA, Europe, and China, and employs 400 staff. It generated EUR 250mn in annual revenue as of June 2024. UBE specializes in materials for automotive, electronics, and pharmaceuticals industries.

Are you interested in M&A intelligence? Request a demo of our platform here